Prior Postings

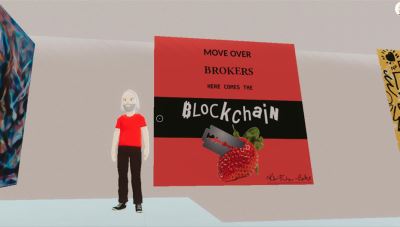

NFTs are a blockchain based technology that have garnered a lot of hype and news coverage in recent months by technology enthusiasts and investors alike. The NBA is using them to sell highlight videos. Artists are using them to sell digital works. Musicians are using them to retain royalties. Twitter’s CEO is even using them […]

(Bloomberg) -- Britain’s Treasury and the Bank of England are weighing the potential creation of a central bank digital currency, joining authorities from China to Sweden exploring the next big step in the future of money.

The NFT market is exploding, providing digital artists a new way to monetize and market their art. Here’s a guide to getting in the game.

When the dust settles, and China and the U.S. and its allies battle it out for control of the supreme digital payment platform, Bitcoin holders will be left holding the bag. Here's why.

How to link an NFT to a digital art piece, and why it’s currently pointless

Non-Fungible Tokens, or NFTs, are big news these days. After an NFT for a piece of digital art by the artist Beeple (Mike Winkelmann) sold for $69 million in March 2021―making it the third-most expensive artwork by a living artist―businesses and their lawyers have been scrambling to understand the legal issues surrounding NFTs, not to mention the meaning and value proposition of this novel class of digital assets for online marketplaces and digital content developers.

The blockchain-backed technology gives artists a way to take ownership and collect compensation for digital works.

The world has started to open its eyes to the true potential of crypto as an alternative to fiat currencies.

Find out why some of the world's largest companies are turning to these specific blockchains to revolutionize their businesses.

If the U.S. reins in pseudonymity in stablecoin transactions, there could be big implications for the crypto industry, says our columnist.